Ah, tax forms. They’re one of those tedious administrative tasks that we simply can’t avoid when it comes to selling artwork online through Print on Demand websites. If you’re using a U.S.-based Print on Demand company like Zazzle, you’ll likely need to fill out and submit a W-8BEN tax form to ensure your payments are processed correctly.

**This post was updated to reflect the most current information available in July 2023.

Let’s dive in and explore the importance of the W-8BEN tax form specifically for royalties on Print on Demand platforms.

Now, this form can be quite confusing, and here’s the kicker: if you fail to submit it or fill it out properly, you might find yourself facing a hefty 30% withholding tax on your royalties. Ouch!

Fortunately, there’s good news for individuals residing in countries that have an income tax treaty with the U.S., like Canada. You may be exempt from paying this hefty withholding tax or, in some cases, eligible for a reduced withholding tax rate. To determine the specific withholding amounts based on your country, refer to the comprehensive list available on the IRS website.

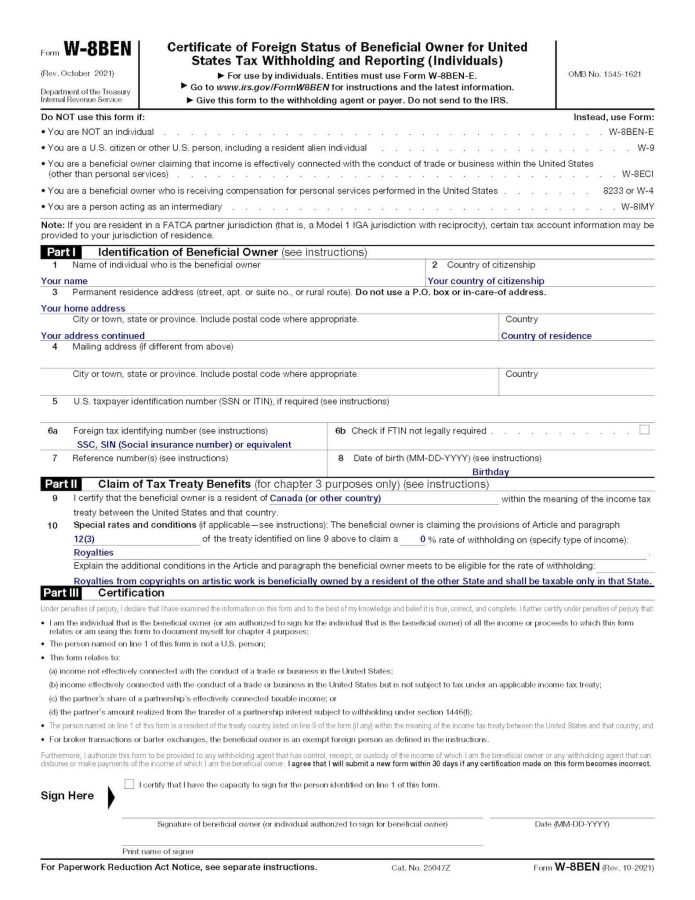

To get started on your tax journey, head over to the IRS website and download the W-8BEN tax form. Now, filling out this form correctly is crucial to ensure your royalties are processed smoothly. Here’s an example of how to complete the form as a Canadian artist.

Let’s go over a few key points to remember:

- The Foreign Tax identifying number (Box 6a) is equivalent to a U.S. Social Security Number and serves as your personal identification number for tax purposes in your country.

- To find the correct Article and Paragraph number you will need to consult the tax document for your Country, which is provided on the IRS website.

- The ____% rate of withholding (Line 10) will vary based on the withholding tax rate of your resident country. Remember to consult the same list provided on the IRS website for the specific rate applicable to you.

In conclusion, dealing with tax forms may be a bit of a hassle, but when it comes to selling your art and earning royalties through Print on Demand websites, it’s crucial to understand and comply with the W-8BEN tax form requirements.

By properly filling out this form and ensuring your eligibility for tax treaty benefits, you can avoid unnecessary withholding taxes and receive your hard-earned royalties in full.

I hope this guide has shed some light on the importance of the W-8BEN tax form for royalty payments on Print on Demand platforms. If you have any thoughts or questions, feel free to leave a comment below.

Cheers to a successful and tax-compliant art-selling journey!

Looking for more information about selling your art through Print on Demand sites? Check out the resources section of my website.

Oh man I was JUST reading up on some stuff and discovered these pesky forms not too long ago! Something often is left out of POD or other sites unless you look real hard — how to deal with the taxes! Thank you for this, this will help. However, I’ve been scouting around Redbubble and planning on opening a store there first. Buut unlike Zazzle (and Society6?) there doesn’t seem to be an area to submit a tax form. On payment details, you got where you put your paypal email, right? Where do you upload the tax form? Do you have to physically send it to them?

Redbubble is based in Australia actually so I think that’s why they don’t require this form, only U.S. based companies will.

Oohh okay, should have guessed that! So what does this mean now for us Canadian shop owners with Redbubble? Do we still have ANY tax forms through Red Bubble, or would it be just the usual filing our taxes as a freelancer (or whatever it is equivalent) for our returns?

I only send them what they ask for, I don’t think there were any tax forms for Redbubble. Your earnings would be claimed at tax time yes, as a freelancer or as “other income” etc.

Okay, good to know, thank you! :)

If you need a free and mobile-friendly guided W-8BEN form, give this one a try at https://www.easyfill.org/f/w8ben. It provides an easy-to-follow guide, smoothly taking you through each step.

Thanks for sharing this, it seems really helpful!